Having just read this superb economic geography article on the Substack Inside China/ Business

China's Marshall Plan For Energy

I had to comment. My remarks follow.

Ha! Now I get the miniscule number of Likes and Restacks for the articles on your page: too much discomforting Reality. Only a few Substackers dare to step into the Truth Zone depicted by your analysis, as supported by the data in the charts and graphs* of the Posts on your page, to find out exactly how much material economic power the US has ceded to foreign producers and transporters in the previous two generations. Instead, most Americans are dazzled by $$$. Isn't "the economy" all about money--in particular, US dollars--as we're continually led to believe, from reading American news stories on economic topics?

No. 35 years ago, American industrial enterprises and manufactured good producers began to be enabled to shift their operations offshore--most often to the newly opened PRC--by the free trade agreements inaugurating the rise of neoliberalism as the prevailing economic regime of international trade. Almost entirely about shifting investment capital (and sometimes technical expertise to oversee the building of the new plants, and trainers to teach how to run them.) And then the investors could just lay back and watch their accounts grow, with all the heavy lifting done outside the US. US investment capital handled the front-end investment and startup end, while their product lines were transformed from US factory goods to a cornucopia of Cheap Stuff imports unloaded from the massive expansion in container shipping. Meanwhile, the effect on the remaining US manufacturers shifted from Free Trade Offshoring being enabled, to being encouraged, to being coerced. Much of our pre-existing industrial plant was already hollowed out by the year 2000. While everyone was enthralled by the dot-com boom and bust. And, of course, Cheap Stuff.* Incredibly cheap (if sometimes shoddy and unrepairable, short-term, one-way to the landfill) consumer goods. Much of it from Chinese, or from Chinese-owned companies elsewhere along the Pacific Rim.

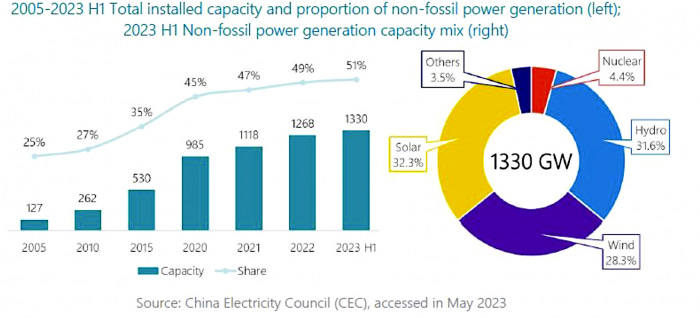

It's like the Trojan Horse. But hey, I don't blame the Chinese. Business is business. The American economy is now 70% consumer spending. We've been partying and coasting while the Chinese are acting like the adults in the room--or more properly the planet, the globe. Chinese industrial enterprises have taken the lead in material development and new natural resources extraction enterprises, particularly in the Global South. The US has been exporting NGOs. The Chinese carbon footprint has expanded dramatically in the free trade era, but they're also leading the world in converting power generation to non-carbon sources. The Chinese are taking conventions like the Paris Agreements seriously. They've obviously accepted the prevailing scientific consensus on the need to ward off the worst consequences of climate change. The Chinese will probably supply the rural electrification--and air conditioning, vital to office and work environments--to the African continent. Meanwhile paying attention to curbing the carbon load of that development. As a result of having an actual “big tent” energy production plan, instead of just talking about one, as with American Republicans bought and paid for by fossil fuels extraction interests chasing that crack.

Meanwhile, the US is now run by Deniers whose only energy policy is Drill Baby Drill, supported by perhaps half of the US population.Persuaded by a propaganda project underwritten by the American fossil fuels industry, the API, and the neoconservative think-tanks. Quarterly profits thinking. Parlay parlay parlay, at the big casino. The sort of people who don't read the American Society of Civil Engineers annual infrastructure report cards, because they're smugly assured of their opinion that the ASCE is a group of Government contractors, and hence biased toward the Liberals. Worse, the ASCE supports the Global Warming Hoax that was concocted by the Satanic Democrat Liberal Conspiracy for the purpose of grifting Billions with the Green New Deal Scam, and also World Takeover.

The 2025 ASCE Report Card grade for the overall condition of American infrastructure is a C. I've been following these reports more or less regularly at least since 2002. That's the highest overall grade I've seen in all the time I've been reading the reports. I plan to check in next year, and the year after that, and see how we're doing with that sort of construction and development. It’s obviously a cornerstone of making America—well, anyway, restoring our country’s strengths, its natural bounty, keeping things livable, improving all that stuff that so many people take for granted.

From the ASCE 2025 Report Card:

The 2025 Report Card for America’s Infrastructure demonstrates that recent federal investments have positively affected many of the infrastructure sectors Americans rely on every day. As a result, incremental improvements were made across some of the historically lowest-graded categories in the Report Card. Almost half of the 18 assessed categories saw increased grades and contributed to an overall grade improvement from C- to C. This is promising momentum, but sustained infrastructure investments are necessary to equip stakeholders with certainty for long-term planning and execution of policies and projects that fully realize the benefits of robust resources. The 2025 grades range from a B in ports to a D in stormwater and transit. For the first time since 1998, no Report Card categories were rated D−. Among the 18 categories assessed, eight saw grade increases. Many of those categories had been chronically stuck at D- or D for years. This improvement was possible due to the government and private sector prioritizing investments in systems that historically had received little attention. Two categories—energy and rail—were downgraded because of concerns related to capacity, future needs, and safety...."

It’s actually really good news, the beginnings of a sound foundation to build on, even given the requirements of a population that’s 340 million, and unlikely to decline for several decades. (although on questions like these, several decades ahead is really too far of a speculative leap.)

"With the 2025 Report Card for America’s Infrastructure, ASCE estimates investment needs total $9.1 trillion for all 18 Report Card categories to reach a state of good repair. Public data and ASCE’s 2024 Bridging the Gap study forecast $5.4 trillion in public and private investments in the 10-year period, 2024 through 2033, if Congress continues recent funding levels. This leaves a gap of $3.7 trillion in investments for America’s infrastructure if we keep investing at current funding levels. However, if Congress were to snap back to investment levels in place prior to recent increases in federal spending, that gap would increase significantly. In fact, ASCE’s Bridging the Gap study, which assesses just 11 of the 18 categories in the 2025 Report Card, finds that the snapback gap would equal the entirety of the 2025 Report Card gap:$3.7 trillion. That figure does not include broadband, dams, levees, hazardous and solid waste, parks, and schools, which represent, at a minimum, an additional gap of $746 billion for a total of $4.4 trillion. Additionally, in that snapback scenario, ASCE estimates meaningful economic harm: $5 trillion lost in gross economicoutput over 20 years, 2024-2043, and a reduction of $244 billion in U.S. exports in those same years. Pre-2021 levels of federal investment also mean a job loss of 344,000 in one snapshot year of 2033. The reduced investments would result in $1.9 trillion in lost disposable income for American families within the 20 years studied..."

As I recall, as of 2005, the deficit in government investment (national, state, local) was estimated by the ASCE as $1.2 trillion. As the ASCE infrastructure funding deficit estimate ballooning to $3.7 trillion makes clear, negating entropy requires considerable maintenance. It costs a lot of money to get the improvements, and to keep them.

Ah, but who believes Civil Engineers, with their chowing down at the pork trough...ignore them, and Make America Great Again! Tax cuts! Heyy..."Rebates", anyone? $5000 Cash Money, in Your Wallet. And then we'll cut the $1 Trillion Deficit and $36 Trillion Debt, by Any Means Necessary...that's right, "we." Me, You, Elon, the President...Us….that's what those $5000--naw, that hasn't happened. Just funnin'.

Like I said, I plan to check back in a year and find out what the ASCE has to say in their 2026 Report. I don't know where all this is heading. But I don't expect the US regaining its former position of industrial trade and economic supremacy. That ship has sailed. Although it does help to explain the US administration's sudden interest in the annexation of Canada and Greenland: it's a desperate attempt to expand our role in world markets as a resource extraction economy. A territorial resource grab. Good old-fashioned Napoleonic geopolitics. (Admit it, Donald Trump was made to pose for a portrait wearing one of those hats. Or maybe in a Western, in a group photo with Forrest Tucker, Larry Storch, and Ken Berry.) If war ever breaks out between the US and Canada, the CCP Politburo will probably be falling down the stairs laughing at the pompous gwailou, exceeding their expectations of stupidity again. Entangled in private ends. The people supposed to be in charge of long-term policy planning for the country they were elected to lead. Conditioned by a quarterly profit model. Parlay parlay parlay.^

There are aspects of PRC policy that I find chillingly frightening. But at least the leadership isn't floundering in a nostalgic mythology-based policy agenda. Performative AntiWokism and belligerent nationalist chauvinism will not save us. Neither will the Austerity Program being carried out by the DGE, in a country where 800 billionaires control more material wealth than the 170 million Americans below the median. https://www.usatoday.com/story/money/2024/07/19/us-billionaires-worth-6t/74453346007/

(*Topics like energy production and shipbuilding tonnage are better suited to metrics than some others, I think.)

(**A consolation prize for house rent--shelter--being a less and less affordable proposition. But that situation was finessed by the new mortgage banking boom of the 2000s, offering absurdly easy credit, closing cost only loans, often at "adjustable rates" with balloon payments a few years down the line. More financialization. And see how it ended.)

(*** Or maybe in a Western. In a group photo with Forrest Tucker, Larry Storch, and Ken Berry.)

[^Elon Musk’s personal version of Longtermism sounds, shall we say, ambitious. And if he finds he can’t get his way, he may have a tantrum. I hope he doesn’t.]

Just one more additional detail. Read the Inside China article China's Marshall Plan For Energy.