Big Cannabis, Legalization, And The Commercial Marketplace: Predictions Of A Legal Marijuana Boom/Epidemic Are Overblown

adapted from a post originally intended as a story comment for the Substack page The Causal Fallacy, where I'm now banned ( which for me is unprecedented- after 25 years on the Internet )

(Prefatory note: my comments have just been banned from the Substack of The Causal Fallacy, written by Charles Fain Lehman. I had been there for only a few days, and had only offered commentary on two of his essays, both on the topic of marijuana legalization. As a result, I was unable to post the text content below, which was originally written as a reply in the story comments discussion for the Causal Fallacy post “How I Changed My Mind About Marijuana Legalization.” I’ve adapted that comment for this post on my own page.

I’m not used to being banned. In my 25 years on the Internet, it might have happened once, in someones personal political blog. Or not. Curious readers might want to visit the Causal Fallacy Substack in order to view the commentary that got me banned; my comments are liable to disappear from that page before long. I do have screen shots of all of the exchanges, backed up, but I’ll refrain from posting them at present. If I learn that my already posted comments have vanished, I suppose I’ll have to go through tedious process of shaping up the screenshots as post content.)

___

This post is prompted by an insightful observation from Substack poster @o b, from story comments on a post found on the Substack page The Causal Fallacy: "i think it’s important to keep in mind with that that like…big weed is a product of deregulated capitalism, and it will remain dominant until more structural campaign finance and lobbying and regulatory issues are addressed and perused. so i see that as pretty much a long game effort too. i think that’s basically what you’re saying, and i agree with the points you’ve made, esp the fucking ridiculous interstate commerce issues this has brought up and the distinction between highest THC levels and good product. drives me crazy the direction VCs took legal weed in so goddamn fast 🫠"

@o b, I agree. It's ghastly. It appears to me that Toxic Wealth Greed Disorder is the most pernicious addictive syndrome in the world.

Unfortunately, the political system is so rigged that at least in the short run, there's no practical prospect of forming a well-funded grassroots public interest lobby in order to purchase an assertive voice in the legislative process, along the lines of Ordinary Good Citizens For Responsibly Regulated Cannabis Legalization. And I wouldn't want to get involved with a PAC or dark money funding of sympathetic officeholders and candidates, even if I could. It isn't just a Swamp; it's more like the edge of an Abyss.

But the sausage has to be made somehow. And the movement to repeal Alcohol Prohibition in the 1930s relied on a lot of big money donors and illustrious business tycoons, too.

I'm hoping that there's a way to fix it in the mix, after Cannabis Prohibition is lifted at the Federal level. The top priority is to retain the right to personal household cultivation. Then we need to address bugs in the regulatory regime like regulatory capture, effective enforcement of age restrictions (which took decades with tobacco, but eventually proved successful); and curbing the market emphasis on ultrahigh THC content products. And a total ban on ads on radio and television- because if that situation that isn’t addressed in advance, they’ll be as common as ads for beer and booze (which should also be forbidden..how did the FCC ever sign off on that?)

In my opinion, superpotent pot and concentrates are a hangover from the era of illegality; they're are responsible for vast majority of harms associated with cannabis abuse while having no particular advantages for users other than the illusion of convenience.

Ironically, twenty years ago, I was speculating that a takeover of pot legalization by Corporate Cannabis would result in homogenized 2% ditchweed being the only legally marketed product. I never anticipated legal shatter hash, wax, 20%+ indoor-grown hydroponic superpot, and 100mg THC candy bars.

All of that is just plain unnecessary, in my opinion. I've been there and done that, and it's senseless. As Martin Lee explains so ably, one of the unique features of THC is that its beneficial effects do not correlate with increasing the amount used:

For adequate symptom relief, some patients may need to ingest a cannabis preparation two or three times during daylight hours in addition to their night-time regimen. Cautious titration is urged: On days 1 and 2, start with one dose of the equivalent of 2.5 mg THC; on days 3 and 4, increase to 2.5 mg THC twice a day; and, if well tolerated, up the dose incrementally to a total of 15 mg THC (divided equally throughout the day).

“Doses exceeding 20-30 mg/day [of THC] may increase adverse events or induce tolerance without improving efficacy,” MacCallum and Russo warn.

Adverse events mainly pertain to THC and are dose-dependent. Very high doses are more likely to cause unwanted side effects.

For most medications, a higher dose will pack a stronger therapeutic punch. With cannabis, however, it’s not so simple. THC and other cannabis components have biphasic properties, meaning that low and high doses generate opposite effects. Small doses of cannabis tend to stimulate; large doses sedate.

In practical terms, this means that starting low and gradually upping the dose of cannabis will produce stronger effects at first. But, after a certain point, “dosage increases can result in weaker therapeutic effects,” according to Dr. Sulak, “and an increase in side effects.” It is important to note that every body responds to THC differently, and builds tolerance at different rates. Check in with yourself often while consuming cannabis to gauge the effects and side effects…

Which is to say that cannabinoids are not like alcohol, cocaine, or opioids. Pot is more like coffee in terms of finding an optimal dose. Two cups of coffee feels great; ten cups of coffee feels terrible. Even for caffeine users with a daily habit, for most of us, taking more than one No-Doz tablet (200mg caffeine) at a time feels terrible. I wish more pot users realized that there's no point in overshooting the mark with pot, either. But popular culture is currently confused by marketing hype (and adolescent street folklore). And even if the venture capitalist investors aren't saying it- or even if they don't realize it- their marketing model is based on high-dollar products used in large amounts by a large user population. Most people prefer the milder forms of cannabis, in low dosages. The only people who tolerate high-potency products well are people who use it so often that cannabis has become their new baseline. That isn't exactly "tolerance", in the sense of opioids or crack. Those users don't go into distress from using an insufficient amount of cannabis. It's more like unreflective inertia; they're just smoking a lot of pot in order to smoke a lot of pot. I'm speaking from experience- including the experience of going for the okey-doke in that regard. After a relatively small amount of pot- miniscule, even, in the case of the concentrates- it just doesn't move the counters that much further as a fun experience. And for occasional users, more often than not, the effect is so instantly disorienting as to be dysphoric. (A notable difference between doing a bongload of superweed and doing a double shot of 100 proof whiskey, which comes on slower and is experienced as relaxing and disinhibiting.)

I think this misplaced emphasis on potency might partially explain why the recent market reports of cannabis investment ventures are just disastrous. From a tip sheet report, May 13, 2022:

“The Money & Markets Cannabis Index shows the decline of the broader cannabis market.

The is an equal-weighted index including all cannabis stocks with a market cap of more than $1 million…

Over the last 12 months, the index value has plummeted 53.6%. The steady decline is frustrating for cannabis investors — especially when you factor in cannabis earnings.” A Bright Spot in Cannabis Earnings Despite the Sell-Off

https://moneyandmarkets.com/cannabis-earnings-market-sell-off/

From a Marketwatch story, November 8, 2022:

“Cannabis earnings show legal U.S. weed sales flattening out as prices decline” Cannabis earnings show legal U.S. weed sales flattening out as prices decline

https://www.msn.com/en-us/money/companies/cannabis-earnings-show-legal-u-s-weed-sales-flattening-out-as-prices-decline/ar-AA13Qxca

Fortune magazine, March 1, 2023:

Legal cannabis sales are on a bad trip in the latest reckoning for the once-booming industry

Legal cannabis sales in states including California and Colorado have tumbled amid the uncertain economy and the end of the pandemic-fueled boom, adding to the industry’s long list of problems after years of euphoric growth.

Taxable sales in California fell 8.3% last year to $5.3 billion, the state department that administers the collection of business taxes and fees said last week. Part of the decline was due to the elimination of a cultivation tax.

In Colorado, marijuana sales fell 20% to $1.8 billion over the same period, according to the state revenue department. Meanwhile, in Washington state, retail revenue for fiscal 2022 fell 8% to $1.4 billion… Legal cannabis sales are on a bad trip in the latest reckoning for the once-booming industry

https://fortune.com/2023/03/01/legal-cannabis-sales-decline-california-washington-colorado/

I understand that the current instability in the cannabis market is to some extent due to uncertainties about the prospect of Federal legalization. But that is far from the whole story. Just look at those declines in the three legal states that have mature markets.

Up in Canada, where recreational cannabis is already legal at the national level:

Trulieve Cannabis misses revenue estimates on weak demand

May 10 (Reuters) - Trulieve Cannabis Corp (TRUL.CD) posted a bigger-than-expected fall in first-quarter revenue on Wednesday, as demand for pot and related products weakened amid rising recession fears and increased competition…

The Florida-based company's net loss doubled from a year earlier to $64 million in the March quarter, with operating expenses up 8% at $163 million.

Revenue fell 9% to $289 million, missing analysts' average expectations of $293 million, according to Refinitiv data. The company said the fall was due to a decline in both retail and wholesale revenues. Trulieve Cannabis misses revenue estimates on weak demand

https://www.reuters.com/business/trulieve-cannabis-posts-lower-first-quarter-revenue-2023-05-10/

That isn’t exactly the juggernaut of infinitely expanding consumption and addiction posited in the narrative of Drug Warrior Cannabis Prohibitionists.

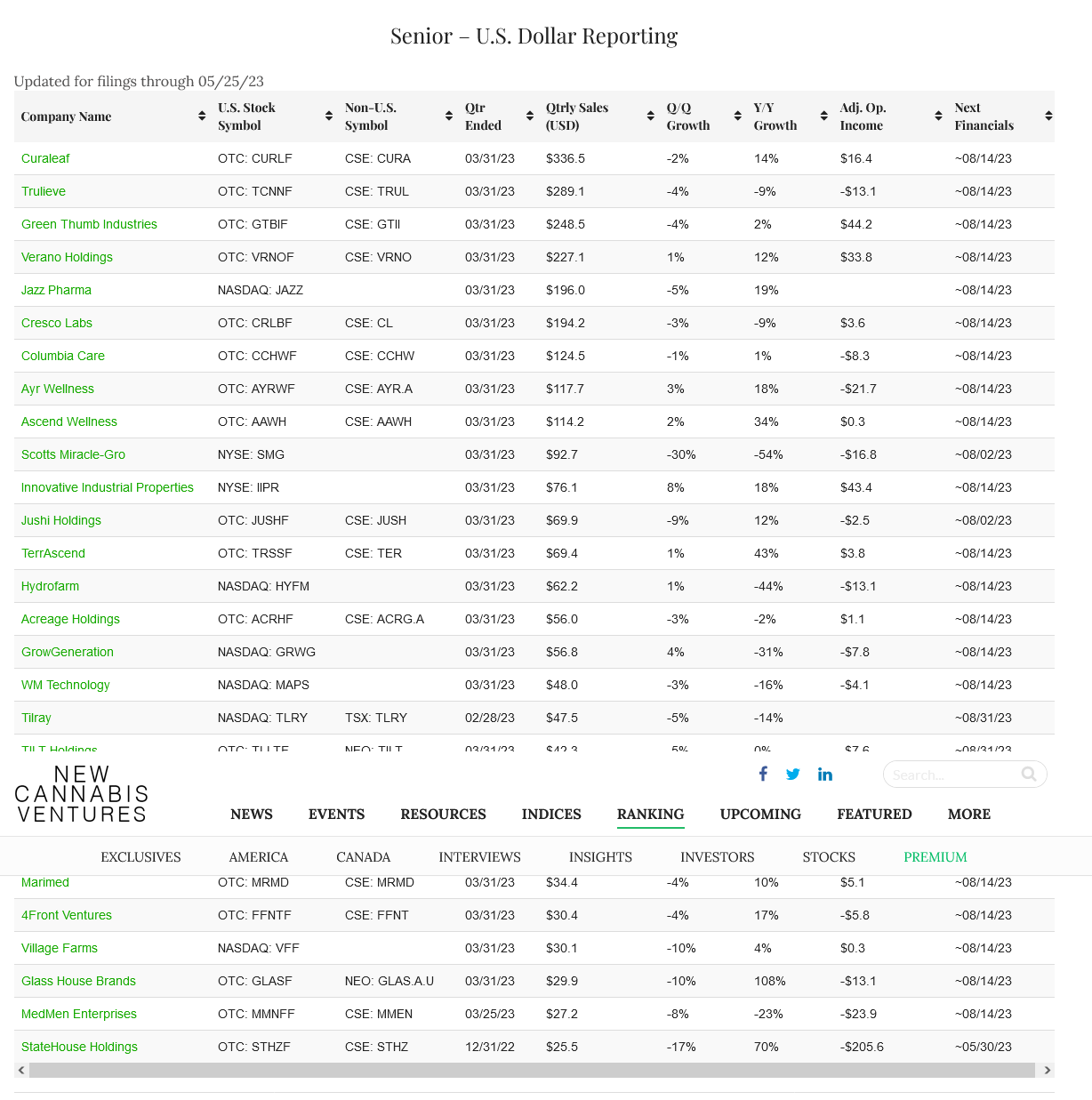

Posted 05/17/2023, the latest quarterly market reports are in from New Cannabis Ventures, which tracks both “Senior” (quarterly sales above $25 million) and “Junior” (below $25 million) cannabis corporations. Of the 28 listed Senior corporations, only 7 posted Q/Q growth: the the most Q/Q growth posted was 8%, by one company. Of the other six, one had 4% growth, one had 3% growth, one had 2% growth, three had 1% growth. The other 21 listed big-league Senior companies posted negative Q/Q growth. (Scott Miracle-Gro Q/Q is down -30%! LOL!!!) Public Cannabis Company Revenue & Income Tracker https://www.newcannabisventures.com/cannabis-company-revenue-ranking/

(I’ve posted the chart at the bottom of the page.)

Aw. And they sounded so optimistic, back in January… Large Cannabis Company Earnings Reports Are Ahead

It has to be said that cannabis is resistant to an alcohol model of consumption; even with an expanding consumer base of users who enjoy it on a regular basis, the amounts used are often trivial. By the time I dropped my regular use of marijuana around 20 years ago, an 1/8 of an ounce was lasting me three weeks! And I was using it every day! Little tiny pinches. That is never going to be a model of consumption that will be profitable. Most American cannabis users fill up on it. That's what the survey reports indicate, year after year. As with the minor spree that Americans took off on in the aftermath of the re-legalization of the alcohol trade in 1934, national cannabis legalization will probably lead to a temporary boost in consumption, along with some rough patches on the way to shifting the retail market away from illicit sources, some of which are quite large plantation or warehouse operations that require the attention of law enforcement (and I’m not talking about someone’s little backyard pot patch.) Because that is how people are. The liminal condition of a society can often get a little giddy when there’s a shift of this sort (although this is nothing, really.) But in the long run, legalization won't lead to a marked increase in cannabis use- much less the skyrocketing rate of "marijuana addiction" that the Drug Warrior Concern Trolls project as an inevitability.

“…After enjoying a sales surge during the pandemic, the U.S. cannabis industry is showing signs of a slowdown as it faces economic and regulatory challenges and people choose to spend their money elsewhere.

In states with established marijuana markets such as Oregon and Washington, sales at retail outlets and dispensaries have declined from a year ago, according to a report from cannabis data firm Headset. In Colorado, one of the country’s most established markets, sales in June were down 11.4% from a year ago.

“What we saw in 2020 was a massive spike in sales tied to the pandemic as people stayed home, had government stimulus money, and not a lot to do,” said Chris Wash, CEO of Marijuana Business Daily.

Between March 2020 and March 2021, average monthly year-over-year sales were up 25.8% in Colorado, according to Headset. But as the pandemic began easing last summer, the report found, both the frequency of marijuana purchases and the amount of money people spent began declining…” Marijuana industry sales slow down after pandemic surge

https://www.cnbc.com/2022/12/09/marijuana-industry-sales-slowdown.html

That’s what’s known as “elastic demand.” Elastic demand is not a feature associated with intensely addictive substances like opioids and nicotine products.

Another phrase I’ve been reading in my sampling of articles on the legal marijuana business is “price compression.” Price compression is a discreet euphemism for the market condition of supply exceeding demand. Lowering prices and stiffer competition. I’d like to see that price spiral end at a point where marijuana is too cheap to bother with robbing or stealing it. But then, I’m one of those “don’t buy retail, grow your own” guys.

The overall tone of the site pages I found with my keyword search continues to be optimistic and boosterish. But they’re mostly tout sheets, or interviews with people in the industry. Talking about what’s gonna happen, not what is happening.

My market advice to investors in recreational cannabis futures is to Get Out Now. Cut Your Losses. Let that market return to a cottage industry of small outdoor garden plots, more like cigar tobacco than vast warehouses of indoor-grown strawberries. Pursue an innovative and responsive medical market- without the despicable monopoly tactic of exploiting DEA Schedule II to obtain regulatory capture of all cannabinoids. (The synthetic compounds are of course very different; and notwithstanding the terrible toxicity of some of them, there’s still considerable therapeutic promise in the research.) And for G~d’s sake, stop ignoring that forgotten orphan, the Industrial Hemp Market. Food, fabrics, cordage, bioplastics, biofuels…